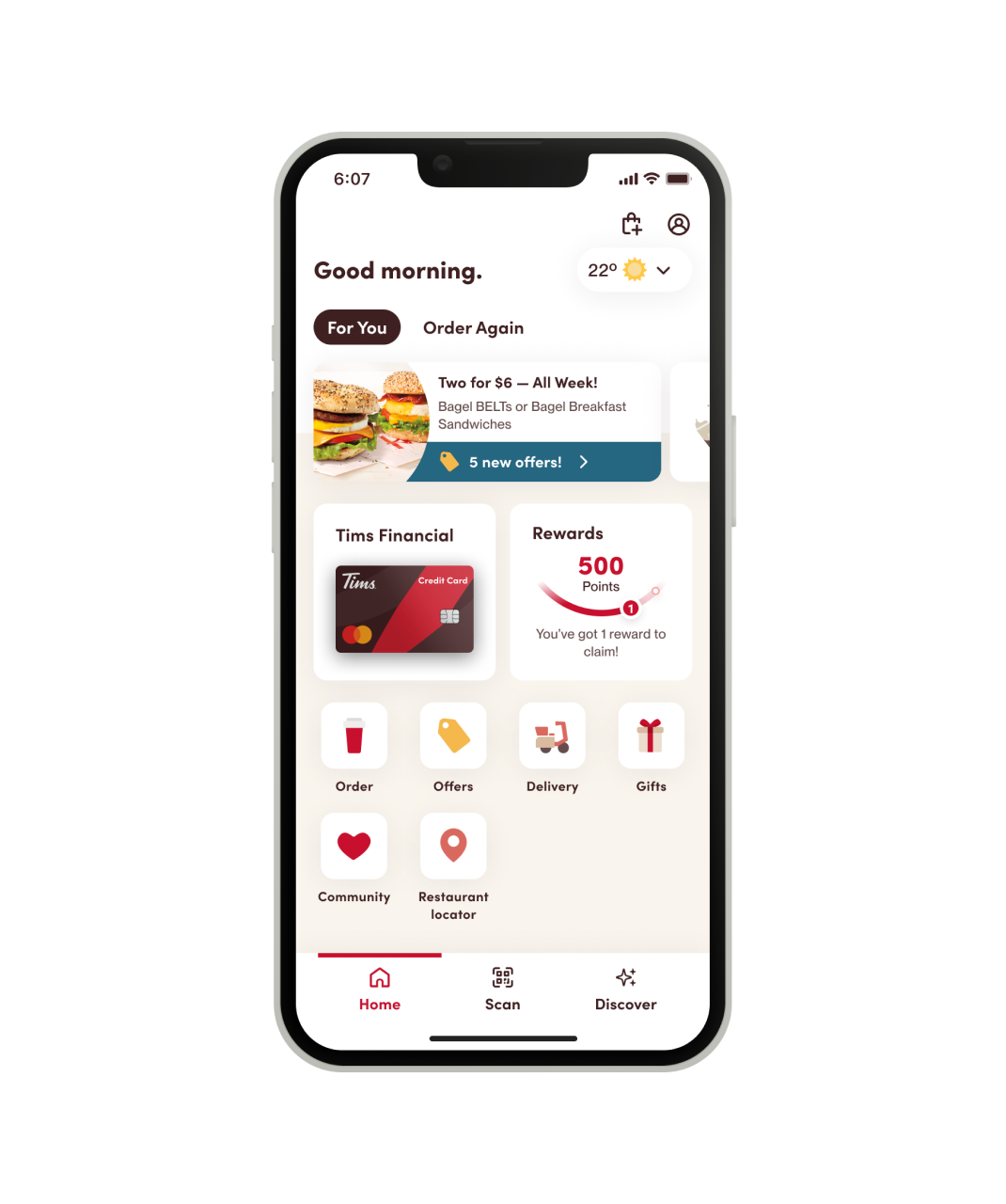

The Tims® Mastercard is only available to Canadian residents.

The Tims® Mastercard is issued by Neo Financial™ pursuant to license by Mastercard International Incorporated.

Mastercard and the circles design is a trademark of Mastercard International Inc. Tims Financial is a registered trademark of Tim Hortons Canada.

Google Play and the Google Play logo are trademarks of Google LLC.

App Store is a trademark of Apple Inc.

1. Tims® Mastercard Offer for unsecured version of the Tims Mastercard: Earn 5 Tims® Rewards Points per CAD $1 spent when you shop for groceries (excluding Walmart and Costco), gas (excluding Costco gas), transit or make an eligible purchase and scan for Tims Rewards at participating Tim Hortons locations in Canada (up to a maximum spend of CAD $20,000 per calendar year in these categories, after which you will earn 1 Tims® Rewards Points per CAD $2 spent). Earn 1 Tims® Rewards Points per CAD $2 spent when you shop everywhere else. Restrictions apply. Certain purchases are prohibited by law from earning points. Tims® Rewards Points can be redeemed for rewards at participating restaurants in Canada. Terms and conditions apply. For details on the Tims® Rewards program, visit timhortons.ca/newtimsrewards.

2. Certain purchases are prohibited by law from earning points.

3. Tims® Statement Credit Offer for unsecured version of the Tims® Mastercard: (a) earn 15 Tims® Rewards Points per CAD $1 spent when you shop make an eligible purchase and scan for Tims Rewards at participating Tim Hortons locations in Canada; (b) earn 5 Tims® Rewards Points per CAD $1 spent on groceries (excluding Walmart and Costco), gas (excluding Costco gas) and transit; and (c) earn Earn 1 Tims® Rewards Point per CAD $2 spent when you shop everywhere else. Up to a maximum spend of CAD $20,000 per calendar year in categories (a) and (b), after which you will earn 1 Tims® Rewards Points per CAD $2 spent. During a current Tims® Mastercard billing cycle, if you have (at the time of redemption): (a) at least the minimum number of Tims® Rewards Points in your Tims® Rewards account required for a statement credit (see app for applicable minimum points balance details), and (b) at least 1 unpaid eligible transaction posted to your Tims® Mastercard account for any good(s) or service(s) to which a statement credit has not already been applied, Tims® Rewards Points may be redeemed towards such good(s) or service(s) (or portion thereof) as a statement credit reward. Offer is valid for one month starting 16/11/2023, and is subject to (i) auto renewal; or (ii) amendment, suspension or termination at any time and for any reason, as determined by TDL. Value of statement credits available shall be in multiples of $5 between $5-$45 CAD. Limit 1 statement credit per 7-day period. Statement Credits are not stackable (limit 1 per eligible good or service). Unpaid transactions from a previous billing cycle, fees and purchases of cryptocurrency, vouchers, gift cards or other or similar items are not eligible. Good(s) or service(s) (or portion thereof) to which a statement credit is applied shall be determined by TDL. Please account for time required to process transactions. Restrictions apply. Other terms apply for the secured version of the Tims® Mastercard. Certain purchases are prohibited by law from earning points. Terms and conditions apply. For details, see timsfinancial.ca for full details.

4. Tims® Statement Credit Offer for secured version of the Tims® Mastercard: (a) earn 12 Tims® Rewards Points per CAD $1 spent when you shop make an eligible purchase and scan for Tims Rewards at participating Tim Hortons locations in Canada; (b) earn 2 Tims® Rewards Points per CAD $1 spent on select essentials (i.e. groceries (excluding Walmart and Costco), gas (excluding Costco gas) and transit); and (c) earn Earn 1 Tims® Rewards Point per CAD $4 spent when you shop everywhere else. Up to a maximum spend of CAD $20,000 per calendar year in categories (a) and (b), after which you will earn 1 Tims® Rewards Points per CAD $4 spent. During a current Tims® Mastercard billing cycle, if you have (at the time of redemption): (a) at least the minimum number of Tims® Rewards Points in your Tims® Rewards account required for a statement credit (see app for applicable minimum points balance details), and (b) at least 1 unpaid eligible transaction posted to your Tims® Mastercard account for any good(s) or service(s) to which a statement credit has not already been applied, Tims® Rewards Points may be redeemed towards such good(s) or service(s) (or portion thereof) as a statement credit reward. Offer is valid for one month starting 16/11/2023, and is subject to (i) auto renewal; or (ii) amendment, suspension or termination at any time and for any reason, as determined by TDL. Value of statement credits available shall be in multiples of $5 between $5-$45 CAD. Limit 1 statement credit per 7-day period. Statement Credits are not stackable (limit 1 per eligible good or service). Unpaid transactions from a previous billing cycle, fees and purchases of cryptocurrency, vouchers, gift cards or other or similar items are not eligible. Good(s) or service(s) (or portion thereof) to which a statement credit is applied shall be determined by TDL. Please account for time required to process transactions. Restrictions apply. Certain purchases are prohibited by law from earning points. Terms and conditions apply. For details, see timsfinancial.ca for full details.

5. The annual interest rate for Purchases on the Tims® Mastercard is 20.99 - 26.99% and for Cash Advances is 22.99% - 27.99%, except if your initial application is for the secured Tims® Mastercard, in which case your annual interest rates are fixed for Purchases at 25.99% and for Cash Advances at 27.99%. For Quebec residents only: Monthly statements; No monthly or annual fees; 21-day grace period; Minimum payment is the higher of $10.00 or 5.0% of total statement balance; Purchase rate 20.99% - 24.99% and cash advance rate 22.99% - 24.99%. The annual rates for Purchases and Cash Advances are dependent on our assessment of your credit application, credit profile, and your province. See your Tims® Mastercard Disclosure Statement, Rate & Fee Schedule at time of application for your specific rates. Example of interest charges (rounded to the nearest cent), based on a 30-day month, are:

6. This insurance coverage is underwritten by Chubb Insurance Company of Canada under a Group Policy issued to Neo Financial Technologies Inc. All coverage is subject to the terms, conditions, limitations and exclusions outlined in the Certificate of Insurance, and for Quebec residents the Summary and Fact Sheet. Neither Neo Financial™ nor The TDL Group Corp (or its employees and representatives) are agents of Chubb, and neither can waive or change any terms of the insurance coverage. To view the full list of insurance certificates visit https://walnut.gowalnut.com/coverage/timsfinancial(opens in a new window)

7. *Pay only for purchases that you have authorized on your Mastercard. Conditions and exceptions apply. To learn more, visit https://www.mastercard.ca/en-ca/vision/who-we-are/terms-of-use/zero-liability-terms-conditions.html(opens in a new window)

8. From May 13, 2025, up to and including June 30, 2025, new customers who apply and are approved for the Tims Mastercard are eligible to receive a $20 CAD Tims Gift Card via email upon their first purchase with their new Tims Mastercard, (the “Welcome Offer”). To receive the Welcome Offer, your first purchase must be made within 30 days of your Tims Mastercard account activation. It can take up to 24 hours from the time of first purchase for the Welcome Offer to be processed and emailed. There is a limit of one Welcome Offer per person, per account, and it cannot be combined with any other offers. This Welcome Offer is subject to the Tims Rewards Terms and Conditions(opens in a new window) and the Tims Rewards – Tims Mastercard Offer Terms and Conditions(opens in a new window).